Instant Life Insurance Quote

Calculate your insurance needs and get instant online life insurance quote

What is Life Insurance?

Put simply, if you were to pass away, life insurance will help protect your loved ones financially. There are two primary types of life insurance — term or permanent. Term life insurance provides insurance protection for a set period — typically 10 to 40 years. Permanent insurance provides coverage for life.

How Does Life Insurance Work?

A life insurance policy is a contract between you and an insurance company. In exchange for your premium payments, the insurance company provides the coverage amount, also known as the death benefit, to your named beneficiaries should something unexpected happen to you.

Do I Need Life Insurance?

A simple rule of thumb is if you have shared debts or anyone relies on your income for their financial well-being, you should consider getting life insurance coverage. And every person’s life insurance needs are different and depend on many factors, such as how many dependents you have, how much you expect to earn, and even your gender.

Life Insurance Case Study

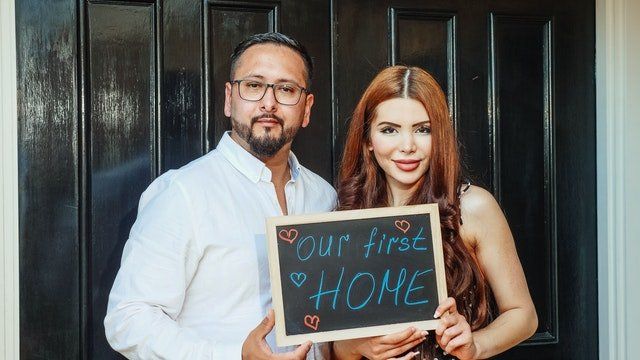

Anthony and Jennifer

Anthony and Jennifer just bought their first home and now have a $500,000 mortgage with a monthly payment of $2,181.

They decided to purchase a 20-year term policy for $500,000 each with a total monthly premium of $53.10 (for both).

Why did they buy Life Insurance?

Anthony and Jennifer know that they would be unable to make their monthly mortgage and bill payments on one salary if one of them were to pass away unexpectedly. The $500,000 benefit would allow for the survivor to pay the mortgage balance and maintain their lifestyle. Without life insurance, the survivor would have to sell the house.

How to Buy Life Insurance

Although in today’s digital age you can buy insurance in many places, and online, it is always best to work with an independent insurance advisor, who can guide you through the options that will fit your specific needs and long-term goals.

How to evaluate and find the best life insurance companies?

When you’re looking for long-term financial confidence, it’s important to choose providers and financial professionals you trust. Look for a life insurance company that shares your values and has the longevity to prove they’ll be there when you need them.

Calculating your Life Insurance Needs

How much life insurance should you buy? You can use the calculator inside the quoting system or speak with one our financial professionals to help determine your needs.

You can use this calculator to help estimate the cost of the protection you may need for your unique situation.

Common mistakes to avoid

A common mistake is not buying enough coverage, so the benefit paid out to your beneficiaries ends up being too small to cover their needs. Waiting too long to buy a life insurance policy can be another costly mistake, as premiums are generally more expensive for older buyers. To help determine how much life insurance to buy.