Term Life Quote

Protect what matters

most

Get a free quote. No obligation, no commitment.

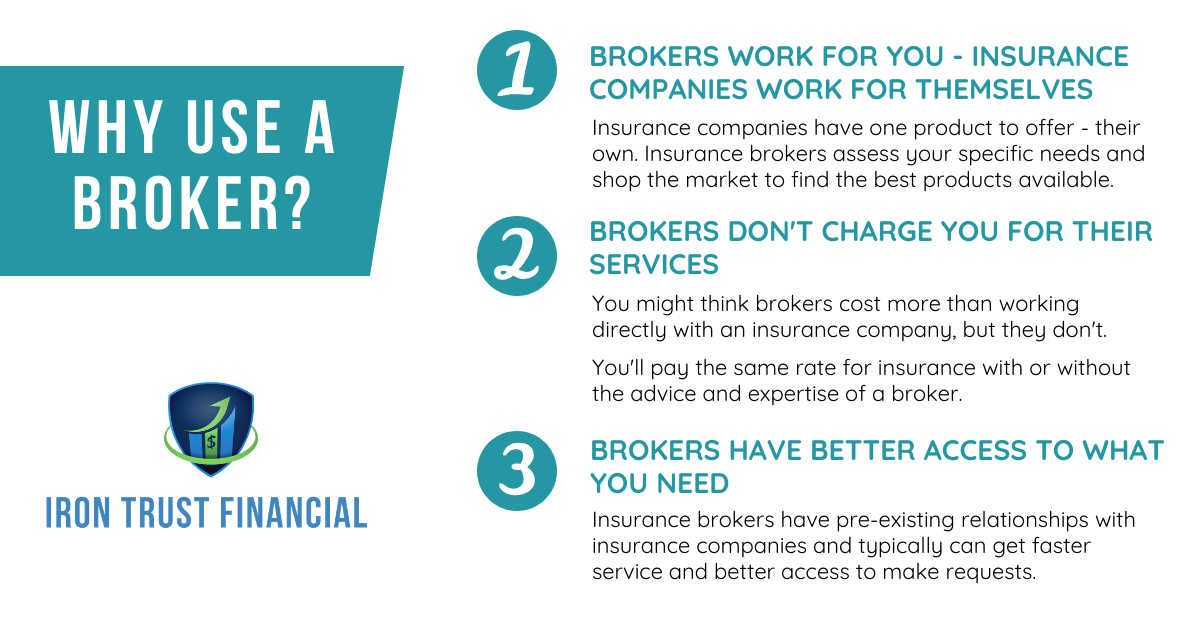

As independent insurance brokers, our goal is find the best solution for you, not just push a product.

We can help you compare all types of coverage while giving you unbiased advice.

Enter quote details here

Helping you determine your life insurance needs

What is insurance?

Insurance is the transferring of a risk (premature death) to an insurance company in return for a premium.

Do I need life insurance?

Ask yourself the following: Do you have someone who depends on your income for their everyday needs?

If the answer is YES, then you probably need life insurance.

What does life insurance protect?

Life insurance can ensure your family can meet their financial obligations if you were to die prematurely.

Examples of what life insurance can help your family achieve if something happened to you:

- Pay the balance of your mortgage or any outstanding debt.

- Replace your income for the next (for example) 20 years.

- Fund your children's education

- Protect your spouse's retirement

- Protect an aging parent's financial security

- Leave a legacy

- Leave a charitable donation

How much insurance do I need?

A financial advisor can help you assess your needs and determine the amount of insurance you and your family need. If you want to review your needs, please contact us to help you.

What is the chance of something actually happening?

Although life expectancy has been increasing in recent years, statistics still show that

1 out of 9 Canadians will die before the age of 65

(https://data.worldbank.org/indicator/SP.DYN.TO65.MA.ZS)

The contents of this site are intended for people in the province of Ontario, Alberta and British Columbia only. Insurance products are provided through Qualified Financial Services Inc., IDC, Worldsource and HUB Financial. Mutual Funds are distributed through Wealthforce Inc.

Iron

Trust

Financial © All rights reserved - 2024